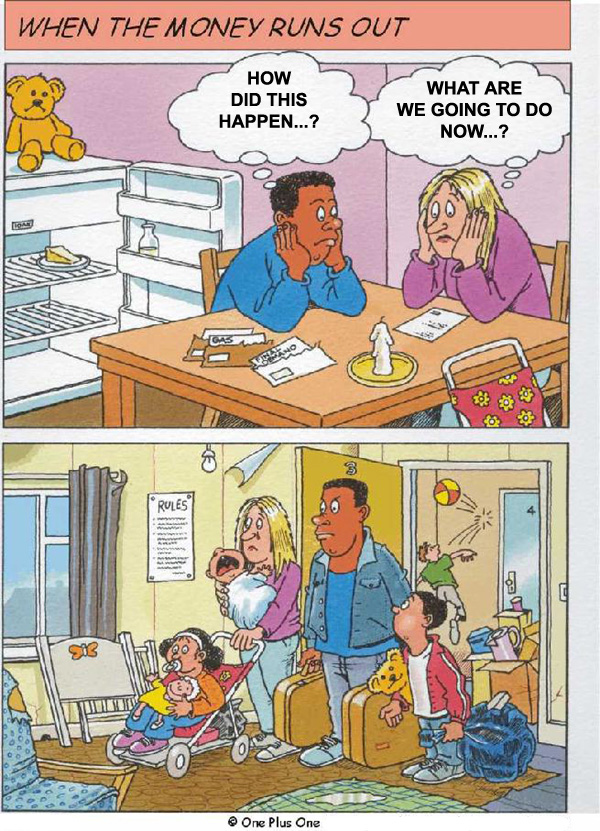

It seems everyone is talking about the credit crunch and what it will mean to them. The extra costs of having children can sometimes make it really hard to manage money. Add to that issues such as redundancy, increased mortgage payments and rising household bills and things can get very tough. As parents most of us try to keep everyone happy, pay bills and spend money on things that seem important, or that we have been pestered for, so it can be a shock if you suddenly find you need an overdraft or get a final demand.

If things do get really bad it is important to face what is going wrong rather than burying your head in the sand, sharing your difficulties together is the best way to sort out the problems. Try not to get into blaming one another (not easy if one of you has been spending a lot on a credit card), but look at money coming in and going out. See if cuts can be made, or look for ways to get more income.

Img Source: investingmoneymastery.com

If it all gets too much you can go for help to somewhere like the Financial Services Authority, Citizens Advice or National Debtline who won’t judge but will try to help.

You might also make a start by drawing up a budget (see our Budget Planner) and perhaps contacting people you owe money to, to try and reduce what you pay.

Feelings will be running high, and worry and guilt can make you row and argue when you really need to support each other. Accept that mistakes may have been made and you’ve learned that you need to keep an eye on your spending. Try to make plans for the future and don’t despair. Even if you can’t sort things out you can go for help to people who know what to do.

Use the cartoon as a start to think about these questions:

- How do you support each other when you are worried about money?

- Do you look at your budget regularly – monthly and what action do you take?

- What do you do when you are really worried about money?